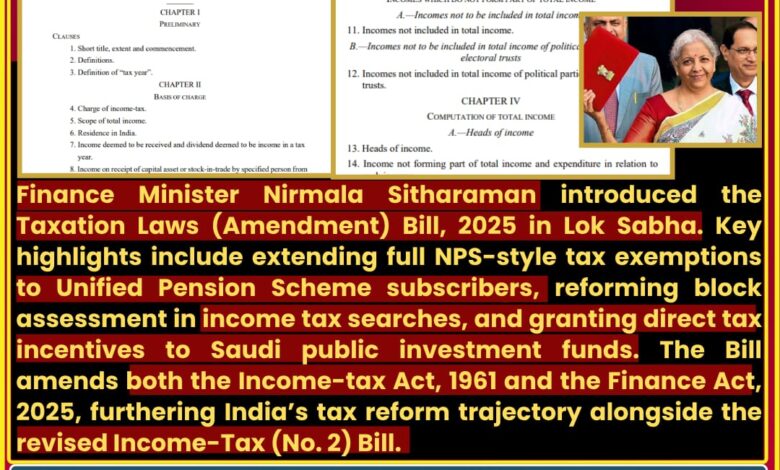

1. Bill Introduced to Harmonize UPS Tax Benefits

On 11 August 2025, Finance Minister Nirmala Sitharaman introduced the Taxation Laws (Amendment) Bill, 2025 in Lok Sabha, aligning tax benefits under the Unified Pension Scheme (UPS) with those available under the New Pension Scheme (NPS). ([turn0search0])

2. Amendments Span Acts and Assessments

The Bill proposes amendments to both the Income-tax Act, 1961 and the Finance Act, 2025, covering a range of tax-related provisions for diverse taxpayer categories and institutional structures. ([turn0search1])

3. UPS Receives Full NPS-Style Exemptions

Subscribers of the UPS, rolled out from 1 April 2025, are now slated to receive the same tax exemptions as NPS holders—boosting retirement savings across India. ([turn0search0])

4. Block Assessment Overhaul in Tax Searches

The amendment reforms block assessment provisions under income tax search cases, aiming to streamline process and improve taxpayer experience during tax scrutiny. ([turn0search1])

5. Saudi Investment Gains Direct Tax Benefits

The Bill also introduces direct tax concessions for Saudi public investment funds, expanding India’s outreach to global capital through preferential tax treatment. ([turn0search0])

6. Legislative Oversight Ensures Accountability

As a financial amendment, the Bill was tabled in Lok Sabha, reflecting its importance in fiscal and governance transparency while mandating quick parliamentary scrutiny. ([turn0search2], general procedure)

7. Enhances Retirement Security and Global Investment

By aligning UPS with NPS benefits and facilitating foreign investment through tax incentives, the Bill potentially strengthens both citizen financial planning and international economic ties. (implied from above)

8. A Key Step in Ongoing Tax Reform

The Amendment Bill complements the ongoing wider tax overhaul marked by the newly introduced Income-Tax (No. 2) Bill, 2025, jointly signaling a comprehensive modernization of India’s tax architecture. ([turn0news10], [turn0news11])