🇺🇸 Trump Calls for Deep Interest Rate Cut by Federal Reserve

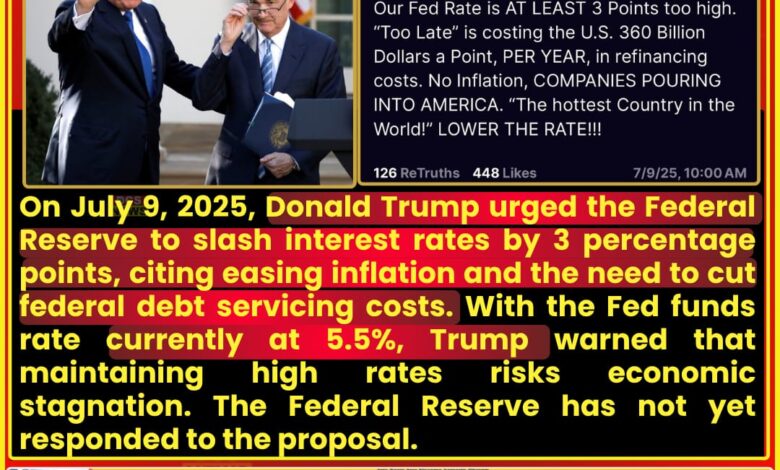

On Wednesday, July 9, 2025, Donald Trump, the former President of the United States, urged the Federal Reserve to implement a massive 3 percentage point cut in the federal benchmark interest rate, aiming to ease the financial pressure caused by the ballooning national debt.

💬 Renewed Demand for Aggressive Rate Cuts

Speaking at a press interaction, Trump emphasized that lowering rates significantly would reduce the cost of servicing U.S. debt, now exceeding $35 trillion. He stated, “We need the Fed to act boldly. A 3% rate cut would help us manage debt costs and drive economic growth.”

📉 Fed Funds Rate Remains High

As of July 2025, the Federal Reserve’s federal funds rate stands in the 5.25%–5.50% range, its highest level in over two decades. The Fed has held rates steady through 2024 and 2025 to combat inflation but is facing increased pressure to pivot as borrowing costs weigh on households and the federal balance sheet.

💡 Economic Logic Behind Trump’s Appeal

Trump argues that with inflation rates now moderating, the Fed has room to lower interest rates without reigniting price surges. He believes such a move would stimulate investment, strengthen business confidence, and reduce the annual interest payments on national debt, which have crossed $1 trillion annually.

🏛️ Political Context: Debt and Election Narratives

Trump’s comments align with his 2024 campaign rhetoric, where he frequently criticized President Joe Biden’s fiscal policies and pledged to restore economic growth through monetary and tax policy shifts. His renewed focus on the Fed comes as election debates increasingly center around inflation, debt, and borrowing costs.

💼 Federal Reserve Maintains Independence

While the Federal Reserve operates independently of the executive branch, presidential pressure on rate decisions is not unprecedented. Under Trump’s previous administration, similar public statements were made urging lower rates to boost growth and curb debt burdens.

🧾 Experts Divided Over Proposed Cut

Economists are split on Trump’s proposal. Some argue a sharp cut could destabilize bond markets or reignite inflation, while others agree that gradual rate easing is necessary to prevent a debt spiral and support the housing and credit markets.

📊 US Debt Outlook Remains Concerning

The Congressional Budget Office (CBO) projects the US federal debt-to-GDP ratio will exceed 119% by 2030. Interest payments on the debt are projected to outpace defense spending by 2026 if current trends persist—intensifying calls for fiscal and monetary recalibration.

🗓️ Market Awaiting Fed’s Next Move

The Federal Reserve’s next policy meeting is scheduled for late July 2025. Markets are closely watching any signal of a pivot toward rate easing, though Fed Chair Jerome Powell has so far maintained a cautious stance on cutting until inflation is firmly under control.

🧭 Looking Forward

With Donald Trump leading in multiple Republican primaries, his economic proposals—especially on interest rates and debt management—are expected to shape the monetary policy discourse through the 2025 election season and beyond.