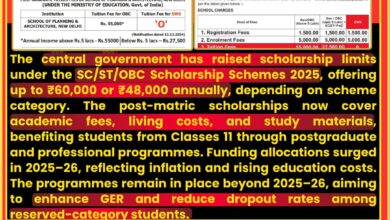

July 26, 2025 | Location: Rourkela, Odisha / Gujarat

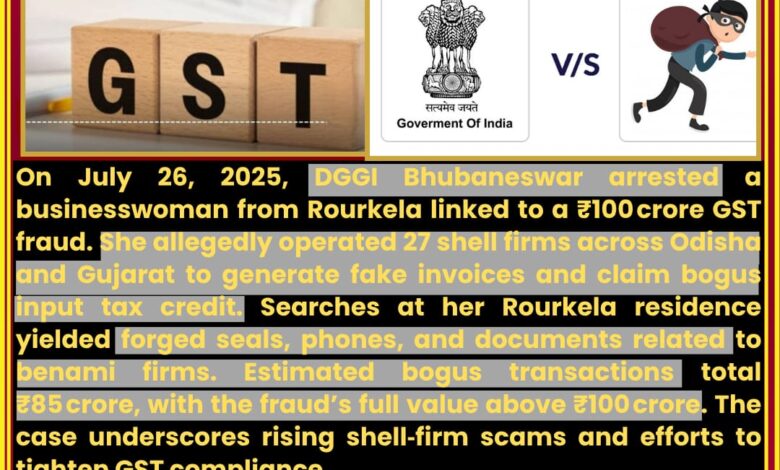

GST sleuths from the Directorate General of GST Intelligence (DGGI), Bhubaneswar zone, arrested a businesswoman from Rourkela on July 25, 2025, in connection with a massive ₹100 crore GST fraud involving the operation of 27 fake, non‑existent firms across Odisha and other states.Gujarat Samachar+14The New Indian Express+14Hindustan Times+14The Times of IndiaReddit+3Hindustan Times+3Hindustan Times+3

Modus Operandi & Firm Network

Investigators uncovered that the accused formed 27 shell companies, many in Odisha and Gujarat, using forged documents and fake seals. These firms issued bogus invoices and e‑way bills solely to claim fraudulent input tax credit (ITC).The New Indian Express+1The Times of India+1 Sites included a firm falsely named in the name of a lawyer in Cuttack, who denied knowledge when officials questioned him.The New Indian Express

Investigation & Seizure

GST officials, acting on intelligence from a Cuttack-based firm inspection, conducted raids at the woman’s residential premises in Rourkela. They seized fake seals, mobile phones, and documents tied to benami firms used to operate the shell network.The Times of India+5The New Indian Express+5The Times of India+5

Scale of Fraud

Preliminary inquiry shows that approximately ₹85 crore in fraudulent transactions was routed through these fake entities over recent years. The total fraud value is estimated at over ₹100 crore.The New Indian Express

Legal Action & Charges

The accused is now facing prosecution under provisions of the CGST Act for evasion through fraudulent ITC claims and use of fake documentation. The DGGI plans to further probe potential links to broader networks operating across state lines.The New Indian Express+1The Times of India+1

Impact & Context

This case comes amid a wave of high-value GST frauds in Gujarat and neighboring states. In 2024 alone, authorities unearthed scams totaling ₹7,000 crore involving bogus input tax credit claims. The state has become a hotspot for shell-company fraud and financial malfeasance.Reddit+11Gujarat Samachar+11The Times of India+11

Comparison with Prior Scams

Earlier notable cases include the arrest of a Rajkot-based man involved in a ₹186 crore GST scam, where fraudulent bills were used to claim ITC in copper trading firms across multiple districts.Reddit+8Gujarat Samachar+8The Times of India+8 That scam resulted in the loss of at least ₹34 crore to the exchequer.The Times of India

Authorities’ Response

DGGI officials stressed that fraud through fake firms and forged bills harms the public exchequer and market integrity. They reiterated ongoing efforts to curb such scams and cancel bogus GST registrations where needed.The New Indian Express+1The Times of India+1

Future Proceedings

Further investigation is expected to track financial flows, beneficiaries, and any additional complicit parties across states. The accused will remain in custody as the legal process under GST and money laundering statutes continues.

Conclusion: Vigilance on Anti-Fraud Front

The arrest marks another major breakthrough in India’s fight against GST fraud. The use of fake entities and fabricated documents to claim input tax credit highlights the pressing need for stricter registration verification and stronger regulatory audits.