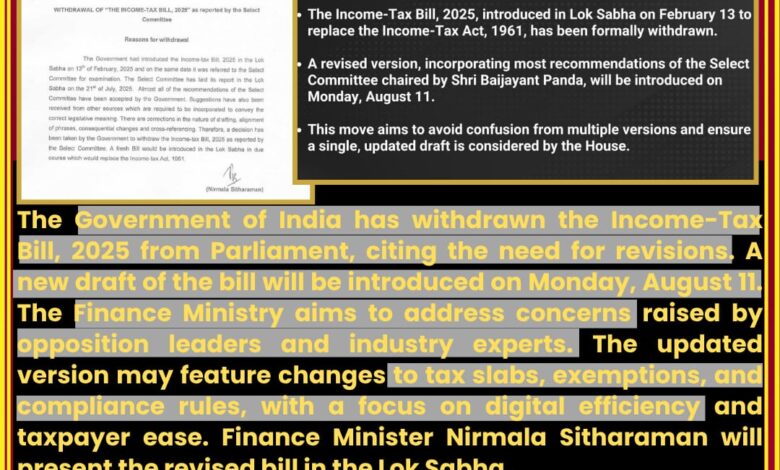

The Union Government on Thursday withdrew the Income-Tax Bill, 2025 from the Lok Sabha, stating that a revised version will be introduced on Monday, August 11. The move comes after internal discussions indicated the need for critical modifications based on stakeholder feedback.

The original version, introduced last month, aimed to overhaul India’s tax structure, streamline processes, and align with global compliance standards. However, the Finance Ministry opted to revisit certain clauses to ensure broader support.

Parliamentary Affairs Minister Pralhad Joshi confirmed the withdrawal during the morning session and assured the House that the updated draft will address concerns raised by opposition parties, experts, and industry bodies.

Sources within the ministry suggest that changes may include altered tax slabs, updated exemptions, and clearer digital compliance rules, especially regarding capital gains and international investments.

Finance Minister Nirmala Sitharaman is expected to lead the tabling of the revised bill. Officials hinted that the new version would provide greater clarity on the taxation of startups, cryptocurrency, and gig economy workers.

Legal experts welcomed the move, saying it reflects the government’s willingness to incorporate public consultation into policy-making. The Bill is now being restructured to ensure both transparency and ease of compliance.

Earlier versions of the Bill had sparked debate over the removal of several exemptions, particularly in relation to housing, education loans, and senior citizen benefits.

Industry groups including CII and FICCI had submitted representations asking for a more inclusive structure that wouldn’t burden middle-class taxpayers or small businesses.

With the Budget already presented earlier this year, the Income-Tax Bill is a key component of the government’s long-term fiscal strategy, aimed at boosting tax collection efficiency and digital accountability.

The revised bill is also expected to include penalty relaxations for first-time defaulters and enhanced deductions for green investments, health insurance, and retirement savings.

Tax policy analysts believe that this withdrawal signals a more consultative and adaptive governance model, especially in sensitive financial legislation.

The new Income-Tax Bill is likely to be passed in the Monsoon Session, with the government holding a clear majority in Parliament. It is part of broader reforms linked to Digital India, financial inclusion, and formalizing the informal economy.

The Opposition, led by Congress and AAP, had earlier demanded a detailed review of the bill and criticized the “hasty” nature of the original draft.

With the updated version expected to be more taxpayer-friendly, it is hoped that the legislation will receive cross-party support and simplify taxation for millions.