July 31, 2025 | Location: New Delhi, India

Indian oil refiners are coming under increasing global scrutiny as the United States and the European Union push harder to isolate Russia economically, particularly in the energy sector. The pressure is mounting on India to reduce or halt crude imports from Russian suppliers, which have become a significant part of India’s energy mix post-2022.

India’s Dependence on Russian Crude Grows

Following the Russia-Ukraine conflict, Indian refiners like Indian Oil Corporation (IOC), Bharat Petroleum (BPCL), and Reliance Industries started purchasing discounted Russian crude, which helped stabilize domestic fuel prices amid global volatility.

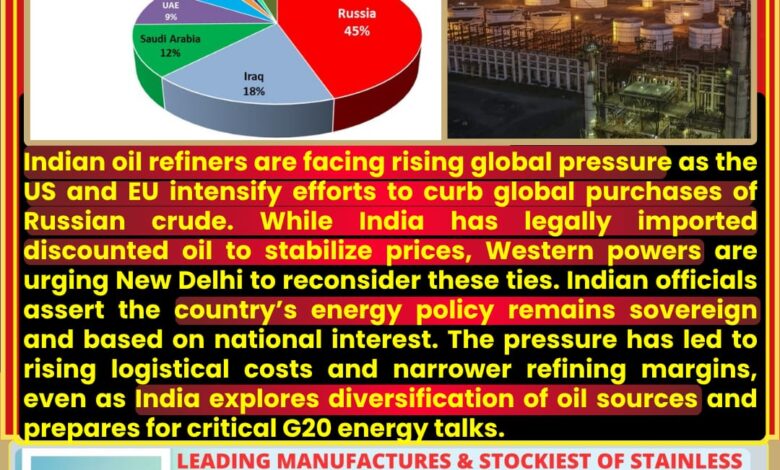

According to official estimates, Russia became India’s top oil supplier in 2023, surpassing traditional sources like Iraq and Saudi Arabia.

Western Push for Compliance

The US Treasury and EU trade envoys have reportedly increased diplomatic efforts urging India to reduce Russian oil dependency. While not violating any international laws, India’s position as a buyer of non-sanctioned Russian crude through price-cap mechanisms has drawn consistent attention from the West.

A senior US official, speaking anonymously, warned that “continued indirect funding of Russian oil revenues undermines global sanctions unity.”

India Balances Energy Needs and Diplomacy

Government sources in New Delhi emphasize that India has not breached any global sanctions and will continue to prioritize affordable energy for its 1.4 billion citizens.

A top official from the Ministry of Petroleum and Natural Gas said:

“We have not received any formal directives. Our oil policy is based on national energy security and pricing stability.”

Impact on Refinery Margins and Trade Routes

The pressure from Western governments has begun to ripple through Indian refineries. Some suppliers and shipping firms are hesitating to service routes involving Russian crude, affecting logistics costs and delivery timelines. Refiners are now forced to find alternate insurance routes, increasing operational expenses.

Market analysts report a drop in refining margins by 8–10% in July 2025 compared to the previous quarter, particularly at western coast refineries.

Future Diversification Plans

Indian refiners are now exploring options to diversify crude imports further by engaging with Latin American, African, and Middle Eastern suppliers. Agreements are under discussion with Brazil, Nigeria, and UAE to balance portfolio risks.

India is also increasing investments in domestic refining capacity and green energy alternatives, aligning with its long-term energy transition goals.

Geopolitical Calculations Ahead of G20

This diplomatic pressure comes ahead of the G20 energy summit, where India is expected to host discussions on energy equity and sustainable sourcing. Western diplomats are likely to raise the issue of indirect support to Russian revenues through crude purchases.

Indian officials maintain that any decisions made will focus on strategic autonomy, reaffirming that no nation should dictate sovereign economic policies.

Conclusion

India’s oil refining sector is caught in a delicate balance between global geopolitical shifts and domestic economic imperatives. While the US and EU continue to harden their stance against Russian energy exports, India insists on preserving its energy affordability and independence, a position likely to define its stance in upcoming global trade talks.