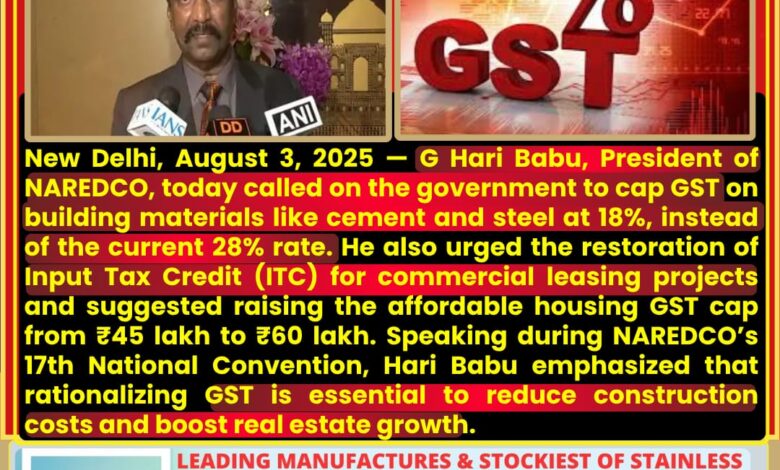

New Delhi, August 3, 2025 — G Hari Babu, President of the National Real Estate Development Council (NAREDCO), has demanded that the Indian government cap the Goods and Services Tax on building materials at 18%, citing the burden of the current 28% rate on key inputs like cement, steel and construction chemicals.The Times of India+11The Economic Times+11The Tribune+11

Speaking at the sidelines of NAREDCO’s 17th National Convention in New Delhi, Hari Babu emphasized that materials taxed at 28% are not ‘luxury’ goods but essentials, and that the higher rate inflates project costs and delays development. He stated: “No GST should be more than 18% on building materials.”The Economic Times

In addition, he requested restoration of Input Tax Credit (ITC) for builders constructing commercial properties for leasing. Currently, affordable housing attracts a 1% GST rate up to ₹45 lakh, while most other under‑construction projects are subject to 5% GST without ITC. However, input credit is disallowed for many materials, creating cash flow challenges for developers.The Economic Times

Hari Babu also proposed raising the ₹45 lakh cap for affordable housing GST to ₹60 lakh, aligning with broader property price trends. Simultaneously, he advocated for allowing developers flexibility to benefit from ITC even at concessional GST rates.The Economic Times

🔧 Sector Impact & Rationale

Currently, GST rates vary by category:

-

Construction services and materials attract 5% to 28% GST depending on type and usage.

-

Affordable housing CGST is charged at 1% (without ITC) up to ₹45 lakh.

-

Beyond that, luxury or commercial material inputs draw 28% GST.

Builders argue the differential taxation adds complexity, erodes margins, and increases final bookings costs for buyers. A cap at 18% could streamline input taxation and preserve affordability.The Economic Times+10The Economic Times+10realtynxt.com+10NewKerala.com+1The Tribune+1

🏙 Policy Context & PP Model Push

During the same event, Delhi Chief Minister Rekha Gupta pledged comprehensive infrastructure reforms for Delhi over the next two years, and invited collaboration with private developers under Public-Private Partnership (PPP) models to build hospitals, schools, commercial centers and enhance urban infrastructure.The Economic Times+1The Economic Times+1

Hari Babu echoed this forward-looking agenda, advocating for climate-smart homes, retrofitting existing buildings, and sustainable development incentives. He stressed that the sector must adopt proactive planning rather than wait for regulatory mandates.The Economic Times+1The Economic Times+1

📉 Broader Implications

Real estate developers say the cap on GST for materials would reduce overall construction costs, encourage new project launches, and drive homebuyer demand. It may also revive stalled affordable housing projects which face tight margin squeezes.

Analysts note that lowering the high‐rate slab would minimize cascading taxation and benefit end‑users, particularly in Tier‑2 and Tier‑3 cities where material sourcing costs form a larger share of project budgets.

Industry stakeholders welcomed the proposal, calling it a “pragmatic step towards rationalizing GST” and urging early policy discussions ahead of Budget 2026 and upcoming GST Council meetings.

✅ Table: Summary of NAREDCO’s GST Proposals

| Proposal | Details & Rationale |

|---|---|

| Cap GST on building materials | Fixed at 18%, down from 28%—for inputs like cement, steel etc. |

| Restore Input Tax Credit (ITC) | Allow for leasing commercial assets to improve cash flow |

| Increase affordable housing limit | Raise threshold from ₹45 lakh to ₹60 lakh |

| Maintain GST flexibility | Allow choice between concessional rate w/o ITC or standard rate with ITC |

🔎 Final Word

G Hari Babu’s latest proposal brings renewed focus to long-standing GST complexities in the real estate sector. With developers facing rising costs, liquidity pressures, and declining affordable housing sales, capping GST at 18% on key materials may offer a lifeline.

As India prepares for Budget 2026, these demands are likely to gain traction in policy circles. A simplified tax structure could boost project viability, housing affordability, and sustainable urban growth.