Mumbai, August 5, 2025

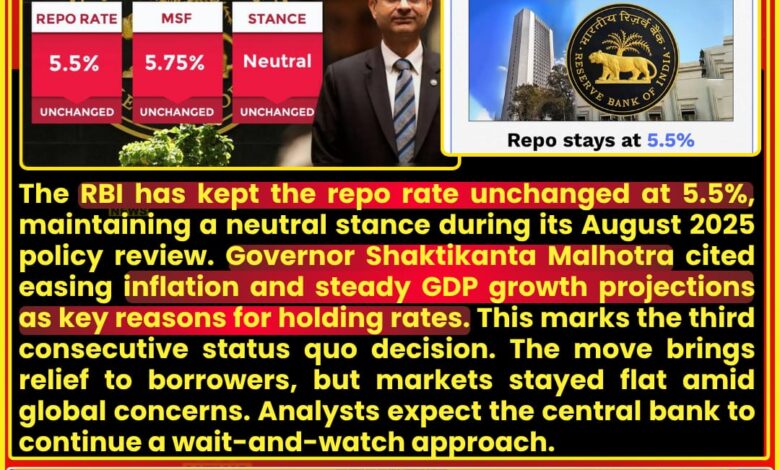

The Reserve Bank of India (RBI), under the leadership of Governor Shaktikanta Malhotra, announced today that it is keeping the benchmark repo rate unchanged at 5.5%, following its Monetary Policy Committee (MPC) meeting. The central bank also maintained a neutral monetary stance, signaling cautious optimism amid mixed economic signals.

📈 Policy Rates Remain Unchanged

The repo rate, which is the rate at which the RBI lends to commercial banks, will remain at 5.5%, consistent with its June 2025 policy. This marks the third consecutive policy where rates have remained steady.

Other key rates also remain unchanged:

-

Reverse Repo Rate: 3.35%

-

Bank Rate & MSF Rate: 5.75%

-

CRR: 4.5%

-

SLR: 18.00%

🧾 RBI’s Justification: Inflation Under Control, Growth Stable

Addressing the media post-announcement, Governor Malhotra stated:

“Inflationary pressures have eased in recent months, and core inflation remains within the RBI’s comfort zone. However, risks from global crude oil prices and climate-related disruptions continue.”

Headline retail inflation stood at 4.6% in July, below the upper band of the RBI’s 4±2% target. The RBI raised its FY26 GDP growth projection to 6.8%, citing stable rural demand and resilient services.

🌍 Global and Domestic Cues Shape RBI’s Neutral Stance

The neutral stance signals that the RBI is neither inclined toward tightening nor easing in the near term. Analysts say the central bank is choosing a “wait-and-watch” mode, given:

-

Geopolitical tensions in Eastern Europe

-

Volatile crude oil markets

-

Monsoon uncertainty impacting food inflation

-

Sluggish exports

🏦 Impact on Markets & Borrowers

The RBI’s decision offers temporary relief to borrowers, with home loan and auto loan interest rates expected to remain stable. However, depositors may see limited movement in FD interest rates in the coming quarter.

The BSE Sensex and Nifty 50 remained largely flat during the Governor’s address, indicating the market had already priced in a status quo.

📊 Economic Snapshot – August 2025

| Indicator | Current Value |

|---|---|

| Repo Rate | 5.5% |

| Inflation (CPI) | 4.6% (July 2025) |

| FY26 GDP Forecast | 6.8% |

| Forex Reserves | $639 billion |

| Crude Oil (Brent) | $87/barrel |

| Rupee vs USD | ₹83.10 |

📌 Expert Take

Economists say the RBI has limited room to ease policy given external risks.

“A prolonged pause is prudent. Rate hikes are off the table unless global risks intensify,” said Radhika Nair, Chief Economist at FinServe India.

📋 Summary

-

RBI holds repo rate at 5.5%, third consecutive pause

-

Neutral stance retained, no signals of rate cuts

-

Inflation softening, but uncertainty persists

-

Borrowers to enjoy continued rate stability

-

Markets react cautiously, as expected