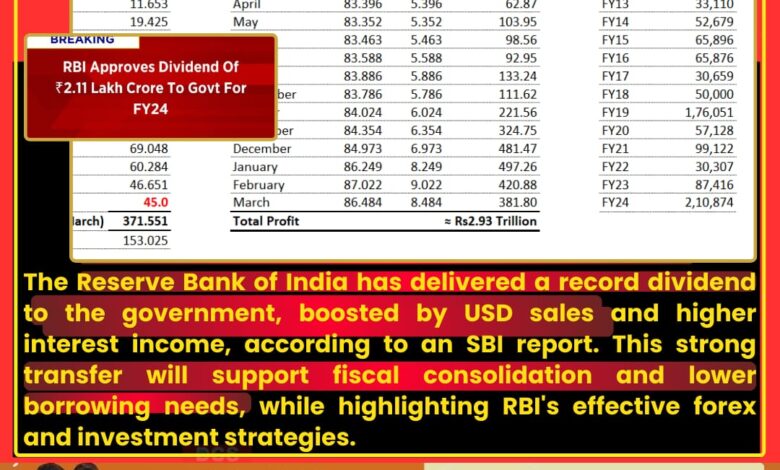

RBI Transfers Record Dividend to Centre in FY25

The Reserve Bank of India (RBI) has delivered a record dividend payout to the Government of India, marking one of the largest surplus transfers in recent fiscal history. As per the latest SBI Research report, this dividend is significantly higher than previous years, providing a strong fiscal boost to the Centre.

USD Sales, Interest Income Drive Surplus

According to the State Bank of India’s economic research team, the substantial payout is primarily driven by:

-

Gains from USD sales in the foreign exchange market

-

Interest income from domestic and international securities

This dual-income stream has considerably expanded RBI’s total surplus available for distribution.

Support for Fiscal Consolidation

The record dividend comes at a crucial time for the government, which is working towards fiscal consolidation goals while managing election-related expenditure and infrastructure investment.

“This large dividend will help narrow the fiscal deficit without cutting back on capital spending,” the report noted.

RBI’s Forex Operations Yield High Returns

The RBI’s strategy of actively intervening in the foreign exchange market during USD volatility periods has paid off. By selling dollars when the Indian rupee showed relative strength, the RBI booked considerable profits amid fluctuating global currency trends.

These actions also helped stabilize the rupee while generating revenue for the central bank’s balance sheet.

Higher Interest Income Boosts Reserves

Interest income from the RBI’s holdings of government bonds, sovereign securities, and global assets has surged, thanks to rising global interest rates over the past year. The RBI’s diversified portfolio is reported to have yielded above-average returns, contributing to the dividend payout.

Positive Market Sentiment and Fiscal Outlook

The report highlights that this larger-than-expected transfer will likely support:

-

Reduced market borrowings

-

Improved liquidity for government schemes

-

Investor confidence in India’s fiscal outlook

Economists also view this as a sign of RBI’s strong financial health and effective reserve management.

Comparison with Past Years

This year’s dividend exceeds the ₹87,416 crore transferred in FY24 and is being closely watched for its macroeconomic implications. The exact figure, expected to cross ₹1 lakh crore, will significantly impact the budgetary math for the central government.